Lease or Finance?

Lease or Finance?

We all have different priorities - in cars, life, and finances. Getting the information you need to make an informed decision about which option suits you, your finances and your lifestyle should be easy.We have a great team of finance experts at Jim Gauthier Chevrolet to help you make this decision. To help you get started, we've put together some industry expert advice to consider.

Priorities to consider

Is leasing right for me?

- You want lower monthly payments

- You want lower monthly payments

- You want the latest in features and safety

- You want the latest in features and safety

- You want a vehicle that is always covered by warranty

- You want a vehicle that is always covered by warranty

- You enjoy driving a new vehicle

- You enjoy driving a new vehicle

- You don't want to worry about selling

- You don't want to worry about selling

- You drive a lower or average amount of km per year

- You drive a lower or average amount of km per year

- Have a stable, predictable lifestyle

- Have a stable, predictable lifestyle

Is financing right for me?

- You want to build ownership equity

- You want to build ownership equity

- You want to add modifications to your vehicle

- You want to add modifications to your vehicle

- You drive your vehicles for an extended length of time

- You drive your vehicles for an extended length of time

- Are prepared to cover repair costs after the warranty ends

- Are prepared to cover repair costs after the warranty ends

- Prefer to have a trade-in

- Prefer to have a trade-in

- You drive a higher number of km per year than average

- You drive a higher number of km per year than average

- You have possible lifestyle changes in the near future

- You have possible lifestyle changes in the near future

Which is more cost-effective?

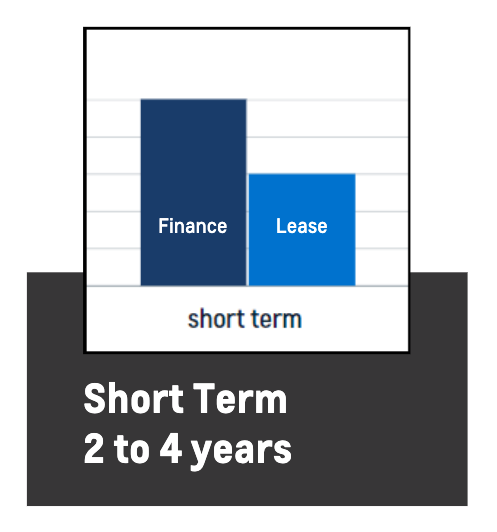

Lease payments are typically lower than finance payments for the same vehicle, at the same price point, with the same down payment regardless of financing or interest rates.

This means leasing can be more cost-effective in the short term by anywhere from 30%-60%

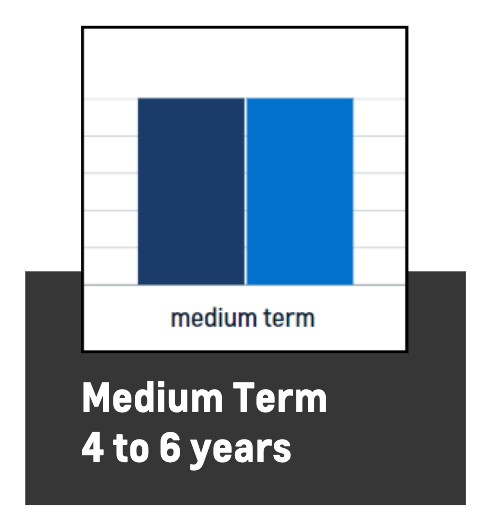

Costs of leasing and financing are fairly even assuming the vehicle will be traded in at the end of the finance/lease term.

Some industry experts believe that either leasing or financing is better however, there is no real cost advantages for either financing or leasing in the medium term.

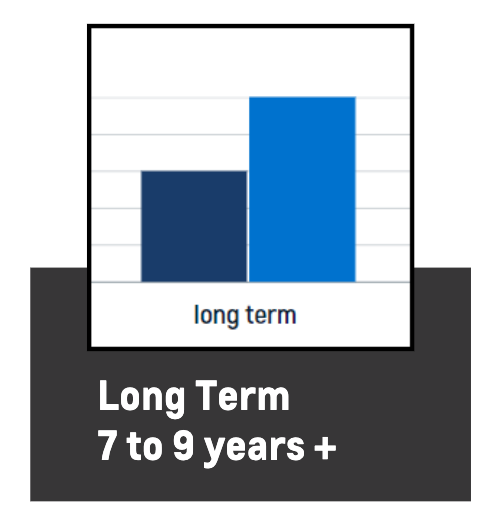

In the long term, financing can have a significant cost advantage. The longer you own that same vehicle the more considerable that advantage becomes.

The risk of unexpectedly higher than average maintenance costs or a total loss of the vehicle through an accident or damage can lessen or even eliminate that advantage.

Strictly looking at costs, should you prefer a new vehicle every few years, then a lease is your most cost-effective option. If you prefer to drive the same vehicle, for as long as possible, the longer you are able to drive that vehicle, the more financing becomes the cost-effective option.